Chapter: 10: COMPANY PROFILES

10.1. ADAPTEVA, INC.

10.1.1. Company overview

10.1.2. Company snapshot

10.1.3. Product portfolio

10.1.4. Key strategic moves and developments

10.1.5. Technological insights and key architecture

10.2. ADVANCED MICRO DEVICES, INC.

10.2.1. Company overview

10.2.2. Company snapshot

10.2.3. Operating business segments

10.2.4. Product portfolio

10.2.5. Business performance

10.2.6. Key strategic moves and developments

10.2.7. Technological insights and key architecture

10.3. ALPHABET INC. (GOOGLE INC.)

10.3.1. Company overview

10.3.2. Company snapshot

10.3.3. Operating business segments

10.3.4. Product portfolio

10.3.5. Business performance

10.3.6. Key strategic moves and developments

10.3.7. Technological insights and key architecture

10.4. AMAZON.COM, INC.

10.4.1. Company overview

10.4.2. Company snapshot

10.4.3. Operating business segments

10.4.4. Product portfolio

10.4.5. Business performance

10.4.6. Key strategic moves and developments

10.4.7. Technological insights and key architecture

10.5. ANALOG DEVICES, INC.

10.5.1. Company overview

10.5.2. Company snapshot

10.5.3. Operating business segments

10.5.4. Product portfolio

10.5.5. Business performance

10.5.6. Technological insights and key architecture

10.6. APPLIED MATERIALS, INC.

10.6.1. Company overview

10.6.2. Company snapshot

10.6.3. Operating business segments

10.6.4. Product portfolio

10.6.5. Business performance

10.6.6. Key strategic moves and developments

10.6.7. Technological insights and key architecture

10.7. BAIDU, INC.

10.7.1. Company overview

10.7.2. Company snapshot

10.7.3. Operating business segments

10.7.4. Product portfolio

10.7.5. Business performance

10.7.6. Key strategic moves and developments

10.7.7. Technological insights and key architecture

10.8. BITMAIN TECHNOLOGIES LTD.

10.8.1. Company overview

10.8.2. Company snapshot

10.8.3. Product portfolio

10.8.4. Key strategic moves and developments

10.8.5. Technological insights and key architecture

10.9. BROADCOM LIMITED

10.9.1. Company overview

10.9.2. Company snapshot

10.9.3. Operating business segments

10.9.4. Product portfolio

10.9.5. Business performance

10.9.6. Technological insights and key architecture

10.10. CAMBRICON TECHNOLOGIES CORPORATION LIMITED

10.10.1. Company overview

10.10.2. Company snapshot

10.10.3. Operating business segments

10.10.4. Product portfolio

10.10.5. Technological insights and key architecture

10.11. DEEPHI TECHNOLOGY CO., LTD.

10.11.1. Company overview

10.11.2. Company snapshot

10.11.3. Operating business segments

10.11.4. Product portfolio

10.11.5. Key strategic moves and developments

10.11.6. Technological insights and key architecture

10.12. GRAPHCORE LTD.

10.12.1. Company overview

10.12.2. Company snapshot

10.12.3. Operating business segments

10.12.4. Product portfolio

10.12.5. Key strategic moves and developments

10.12.6. Technological insights and key architecture

10.13. GROQ

10.13.1. Company overview

10.13.2. Company snapshot

10.13.3. Product portfolio

10.13.4. Technological insights and key architecture

10.14. GYRFALCON TECHNOLOGY INC.

10.14.1. Company overview

10.14.2. Company snapshot

10.14.3. Operating business segments

10.14.4. Product portfolio

10.14.5. Technological insights and key architecture

10.15. HORIZON ROBOTICS, INC.

10.15.1. Company overview

10.15.2. Company snapshot

10.15.3. Product portfolio

10.15.4. Technological insights and key architecture

10.16. HUAWEI TECHNOLOGIES CO. LTD.

10.16.1. Company overview

10.16.2. Company snapshot

10.16.3. Operating business segments

10.16.4. Product portfolio

10.16.5. Business performance

10.16.6. Key strategic moves and developments

10.16.7. Technological insights and key architecture

10.17. INTEL CORPORATION

10.17.1. Company overview

10.17.2. Company snapshot

10.17.3. Operating business segments

10.17.4. Product portfolio

10.17.5. Business performance

10.17.6. Key strategic moves and developments

10.17.7. Technological insights and key architecture

10.18. INTERNATIONAL BUSINESS MANAGEMENT CORPORATION

10.18.1. Company overview

10.18.2. Company snapshot

10.18.3. Operating business segments

10.18.4. Product portfolio

10.18.5. Business performance

10.18.6. Key strategic moves and developments

10.18.7. Technological insights and key architecture

10.19. KNUEDGE, INC.

10.19.1. Company overview

10.19.2. Company snapshot

10.19.3. Product portfolio

10.19.4. Technological insights and key architecture

10.20. KRTKL INC.

10.20.1. Company overview

10.20.2. Company snapshot

10.20.3. Product portfolio

10.20.4. Technological insights and key architecture

10.21. MEDIATEK, INC.

10.21.1. Company overview

10.21.2. Company snapshot

10.21.3. Operating business segments

10.21.4. Product portfolio

10.21.5. Business performance

10.21.6. Key strategic moves and developments

10.21.7. Technological insights and key architecture

10.22. MICRON TECHNOLOGY, INC.

10.22.1. Company overview

10.22.2. Company snapshot

10.22.3. Operating business segments

10.22.4. Product portfolio

10.22.5. Business performance

10.22.6. Technological insights and key architecture

10.23. MICROSEMI CORPORATION

10.23.1. Company overview

10.23.2. Company snapshot

10.23.3. Operating business segments

10.23.4. Product portfolio

10.23.5. Business performance

10.23.6. Key strategic moves and developments

10.23.7. Technological insights and key architecture

10.24. MYTHIC, INC.

10.24.1. Company overview

10.24.2. Company snapshot

10.24.3. Product portfolio

10.24.4. Key strategic moves and developments

10.24.5. Technological insights and key architecture

10.25. NEC CORPORATION

10.25.1. Company overview

10.25.2. Company snapshot

10.25.3. Operating business segments

10.25.4. Product portfolio

10.25.5. Business performance

10.25.6. Key strategic moves and developments

10.25.7. Technological insights and key architecture

10.26. KOREA ELECTRONIC CERTIFICATION AUTHORITY, INC. (AI BRAIN, INC.)

10.26.1. Company overview

10.26.2. Company snapshot

10.26.3. Operating business segments

10.26.4. Product portfolio

10.26.5. Technological insights and key architecture

10.27. NVIDIA CORPORATION

10.27.1. Company overview

10.27.2. Company snapshot

10.27.3. Operating business segments

10.27.4. Product portfolio

10.27.5. Business performance

10.27.6. Key strategic moves and developments

10.27.7. Technological insights and key architecture

10.28. NXP SEMICONDUCTORS N.V.

10.28.1. Company overview

10.28.2. Company snapshot

10.28.3. Operating business segments

10.28.4. Product portfolio

10.28.5. Business performance

10.28.6. Key strategic moves and developments

10.28.7. Technological insights and key architecture

10.29. QUALCOMM INCORPORATED

10.29.1. Company overview

10.29.2. Company snapshot

10.29.3. Operating business segments

10.29.4. Product portfolio

10.29.5. Business performance

10.29.6. Key strategic moves and developments

10.29.7. Technological insights and key architecture

10.30. SAMSUNG ELECTRONICS CO. LTD.

10.30.1. Company overview

10.30.2. Company snapshot

10.30.3. Operating business segments

10.30.4. Product portfolio

10.30.5. Business performance

10.30.6. Key strategic moves and developments

10.30.7. Technological insights and key architecture

10.31. SHANGHAI THINK-FORCE ELECTRONIC TECHNOLOGY CO. LTD.

10.31.1. Company overview

10.31.2. Company snapshot

10.31.3. Product portfolio

10.31.4. Technological insights and key architecture

10.32. SK HYNIX, INC.

10.32.1. Company overview

10.32.2. Company snapshot

10.32.3. Operating business segments

10.32.4. Product portfolio

10.32.5. Business performance

10.32.6. Technological insights and key architecture

10.33. SOFTBANK GROUP CORP. (ARM HOLDINGS PLC)

10.33.1. Company overview

10.33.2. Company snapshot

10.33.3. Operating business segments

10.33.4. Product portfolio

10.33.5. Business performance

10.33.6. Key strategic moves and developments

10.33.7. Technological insights and key architecture

10.34. TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

10.34.1. Company overview

10.34.2. Company snapshot

10.34.3. Operating business segments

10.34.4. Product portfolio

10.34.5. Business performance

10.34.6. Technological insights and key architecture

10.35. TENSTORRENT INC.

10.35.1. Company overview

10.35.2. Company snapshot

10.35.3. Product portfolio

10.35.4. Technological insights and key architecture

10.36. TEXAS INSTRUMENTS INCORPORATED

10.36.1. Company overview

10.36.2. Company snapshot

10.36.3. Operating business segments

10.36.4. Product portfolio

10.36.5. Business performance

10.36.6. Technological insights and key architecture

10.37. TOSHIBA CORPORATION

10.37.1. Company overview

10.37.2. Company snapshot

10.37.3. Operating business segments

10.37.4. Product portfolio

10.37.5. Business performance

10.37.6. Key strategic moves and developments

10.37.7. Technological insights and key architecture

10.38. UNIVERSITY OF CALIFORNIA SYSTEM (UNIVERSITY OF CALIFORNIA, DAVIS)

10.38.1. Company overview

10.38.2. Company snapshot

10.38.3. Operating business segments

10.38.4. Product portfolio

10.38.5. Business performance

10.38.6. Technological insights and key architecture

10.39. WAVE COMPUTING, INC.

10.39.1. Company overview

10.39.2. Company snapshot

10.39.3. Product portfolio

10.39.4. Key strategic moves and developments

10.39.5. Technological insights and key architecture

10.40. XILINX, INC.

10.40.1. Company overview

10.40.2. Company snapshot

10.40.3. Operating business segments

10.40.4. Product portfolio

10.40.5. Business performance

10.40.6. Technological insights and key architecture

LIST OF TABLES

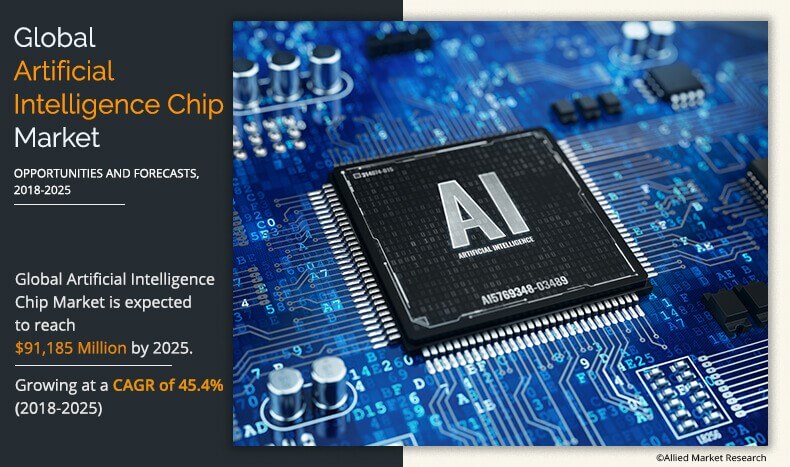

TABLE 01. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 2017-2025($MILLION)

TABLE 02. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR GPU, BY REGION 2017-2025 ($MILLION)

TABLE 03. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR ASIC, BY REGION 2017-2025 ($MILLION)

TABLE 04. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR FPGA, BY REGION 20172025 ($MILLION)

TABLE 05. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR CPU, BY REGION 20172025 ($MILLION)

TABLE 06. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR OTHERS, BY REGION 20172025 ($MILLION)

TABLE 07. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 2017-2025($MILLION)

TABLE 08. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR MACHINE LEARNING, BY REGION 2017-2025 ($MILLION)

TABLE 09. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR NLP, BY REGION 2017-2025 ($MILLION)

TABLE 10. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR ROBOTIC PROCESS AUTOMATION, BY REGION 20172025 ($MILLION)

TABLE 11. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR SPEECH RECOGNITION, BY REGION 20172025 ($MILLION)

TABLE 12. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR OTHERS, BY REGION 20172025 ($MILLION)

TABLE 13. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 2017-2025($MILLION)

TABLE 14. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR SYSTEM-ON-CHIP (SOC), BY REGION 2017-2025 ($MILLION)

TABLE 15. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR SYSTEM-IN-PACKAGE (SIP), BY REGION 2017-2025 ($MILLION)

TABLE 16. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR MULTI-CHIP MODULE, BY REGION 20172025 ($MILLION)

TABLE 17. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR OTHERS, BY REGION 20172025 ($MILLION)

TABLE 18. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 2017-2025($MILLION)

TABLE 19. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR SYSTEM-ON-CHIP (SOC), BY REGION 2017-2025 ($MILLION)

TABLE 20. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR CLOUD, BY REGION 2017-2025 ($MILLION)

TABLE 21. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUTRY VERTICAL, 20172025 ($MILLION)

TABLE 22. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 23. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR MEDIA & ADVERTISING, BY REGION, 20172025 ($MILLION)

TABLE 24. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR MEDIA & ADVERTISING, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 25. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR BFSI, BY REGION 2017-2025 ($MILLION)

TABLE 26. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR BFSI, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 27. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR IT & TELECOM, BY REGION, 20172025 ($MILLION)

TABLE 28. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR IT & TELECOM, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 29. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR RETAIL, BY REGION, 20172025 ($MILLION)

TABLE 30. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR RETAIL, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 31. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR HEALTHCARE, BY REGION 20172025 ($MILLION)

TABLE 32. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR HEALTHCARE, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 33. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR AUTOMOTIVE, BY REGION 20172025 ($MILLION)

TABLE 34. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR AUTOMOTIVE, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 35. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR OTHERS, BY REGION, 20172025 ($MILLION)

TABLE 36. ARTIFICIAL INTELLIGENCE CHIP MARKET REVENUE FOR OTHERS, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 37. NORTH AMERICAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 38. NORTH AMERICAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 39. NORTH AMERICAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 40. NORTH AMERICAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 41. NORTH AMERICAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 42. U. S. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 43. U. S. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 44. U. S. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 45. U. S. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 46. U.S. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 47. CANADA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 48. CANADA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 49. CANADA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 50. CANADA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 51. CANADA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 52. MEXICO ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 53. MEXICO ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 54. MEXICO ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 55. MEXICO ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 56. MEXICO ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 57. EUROPEAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 58. EUROPEAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 59. EUROPEAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 60. EUROPE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 61. EUROPEAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 62. U.K. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 63. U.K. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 64. U.K. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 65. UK ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 66. U.K. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 67. GERMANY ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 68. GERMANY ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 69. GERMANY ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 70. GERMANY ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 71. GERMANY ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 72. FRANCE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 73. FRANCE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 74. FRANCE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 75. FRANCE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 76. FRANCE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 77. RUSSIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 78. RUSSIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 79. RUSSIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 80. RUSSIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 81. RUSSIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 82. REST OF EUROPE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 83. REST OF EUROPE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 84. REST OF EUROPE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 85. REST OF EUROPE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 86. REST OF EUROPE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 87. ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 88. ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 89. ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 90. ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 91. ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 92. CHINA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 93. CHINA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 94. CHINA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 95. CHINA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 96. CHINA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 97. JAPAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 98. JAPAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 99. JAPAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 100. JAPAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 101. JAPAN ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 102. INDIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 103. INDIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 104. INDIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 105. INDIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 106. INDIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 107. AUSTRALIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 108. AUSTRALIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 109. AUSTRALIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 110. AUSTRALIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 111. AUSTRALIA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 112. REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 113. REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 114. REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 115. REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 116. REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 117. LAMEA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 118. LAMEA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 119. LAMEA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 120. LAMEA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 121. LAMEA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 122. LATIN AMERICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 123. LATIN AMERICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 124. LATIN AMERICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 125. LATIN AMERICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 126. LATIN AMERICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 127. MIDDLE EAST ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 128. MIDDLE EAST ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 129. MIDDLE EAST ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 130. MIDDLE EAST ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 131. MIDDLE EAST ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 132. AFRICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY CHIP TYPE, 20172025 ($MILLION)

TABLE 133. AFRICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY APPLICATION, 20172025 ($MILLION)

TABLE 134. AFRICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY TECHNOLOGY, 20172025 ($MILLION)

TABLE 135. AFRICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY PROCESSING TYPE, 20172025 ($MILLION)

TABLE 136. AFRICA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY INDUSTRY VERTICAL, 20172025 ($MILLION)

TABLE 137. ADAPTEVA: COMPANY SNAPSHOT

TABLE 138. ADAPTEVA: PRODUCT PORTFOLIO

TABLE 139. ADAPTEVA: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 140. AMD: COMPANY SNAPSHOT

TABLE 141. AMD: OPERATING SEGMENTS

TABLE 142. AMD: PRODUCT PORTFOLIO

TABLE 143. AMD: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 144. ALPHABET: COMPANY SNAPSHOT

TABLE 145. ALPHABET: OPERATING SEGMENTS

TABLE 146. ALPHABET: PRODUCT PORTFOLIO

TABLE 147. ALPHABET: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 148. AMAZON.COM: COMPANY SNAPSHOT

TABLE 149. AMAZON.COM: OPERATING SEGMENTS

TABLE 150. AMAZON.COM: PRODUCT PORTFOLIO

TABLE 151. AMAZON.COM: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 152. ANALOG DEVICES: COMPANY SNAPSHOT

TABLE 153. ANALOG DEVICES: OPERATING SEGMENTS

TABLE 154. ANALOG DEVICES: PRODUCT PORTFOLIO

TABLE 155. ANALOG DEVICES: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 156. APPLIED MATERIALS: COMPANY SNAPSHOT

TABLE 157. APPLIED MATERIALS: OPERATING SEGMENTS

TABLE 158. APPLIED MATERIALS: PRODUCT PORTFOLIO

TABLE 159. APPLIED MATERIALS: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 160. BAIDU: COMPANY SNAPSHOT

TABLE 161. BAIDU: OPERATING SEGMENTS

TABLE 162. BAIDU: PRODUCT PORTFOLIO

TABLE 163. BAIDU: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 164. BITMAIN TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 165. BITMAIN TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 166. BITMAIN TECHNOLOGIES: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 167. BROADCOM: COMPANY SNAPSHOT

TABLE 168. BROADCOM: OPERATING SEGMENTS

TABLE 169. BROADCOM: PRODUCT PORTFOLIO

TABLE 170. BROADCOM: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 171. CAMBRIAN TECHNOLOGY: COMPANY SNAPSHOT

TABLE 172. CAMBRIAN TECHNOLOGY: OPERATING SEGMENTS

TABLE 173. CAMBRIAN TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 174. CAMBRIAN TECHNOLOGY: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 175. DEEPHI TECH: COMPANY SNAPSHOT

TABLE 176. DEEPHI TECH: OPERATING SEGMENTS

TABLE 177. DEEPHI TECH: PRODUCT PORTFOLIO

TABLE 178. DEEPHI TECH: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 179. GRAPHCORE: COMPANY SNAPSHOT

TABLE 180. GRAPHCORE: OPERATING SEGMENTS

TABLE 181. GRAPHCORE: PRODUCT PORTFOLIO

TABLE 182. GRAPHCORE: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 183. GROQ: COMPANY SNAPSHOT

TABLE 184. GROQ: PRODUCT PORTFOLIO

TABLE 185. GROQ: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 186. GYRFALCON TECHNOLOGY: COMPANY SNAPSHOT

TABLE 187. GYRFALCON TECHNOLOGY: OPERATING SEGMENTS

TABLE 188. GYRFALCON TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 189. GYRFALCON TECHNOLOGY: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 190. HORIZON ROBOTICS: COMPANY SNAPSHOT

TABLE 191. HORIZON ROBOTICS: PRODUCT PORTFOLIO

TABLE 192. HORIZON ROBOTICS: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 193. HUAWEI: COMPANY SNAPSHOT

TABLE 194. HUAWEI: OPERATING SEGMENTS

TABLE 195. HUAWEI: PRODUCT PORTFOLIO

TABLE 196. HUAWEI: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 197. INTEL: COMPANY SNAPSHOT

TABLE 198. INTEL: OPERATING SEGMENTS

TABLE 199. INTEL: PRODUCT PORTFOLIO

TABLE 200. INTEL: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 201. IBM: COMPANY SNAPSHOT

TABLE 202. IBM: OPERATING SEGMENTS

TABLE 203. IBM: PRODUCT PORTFOLIO

TABLE 204. IBM: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 205. KNUEDGE: COMPANY SNAPSHOT

TABLE 206. KNUEDGE: PRODUCT PORTFOLIO

TABLE 207. KNUEDGE: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 208. KRTKL: COMPANY SNAPSHOT

TABLE 209. KRTKL: PRODUCT PORTFOLIO

TABLE 210. KRTKL: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 211. MEDIATEK: COMPANY SNAPSHOT

TABLE 212. MEDIATEK: PRODUCT PORTFOLIO

TABLE 213. MEDIATEK: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 214. MICRON: COMPANY SNAPSHOT

TABLE 215. MICRON: OPERATING SEGMENTS

TABLE 216. MICRON: PRODUCT PORTFOLIO

TABLE 217. MICRON: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 218. MICROSEMI: COMPANY SNAPSHOT

TABLE 219. MICROSEMI: PRODUCT PORTFOLIO

TABLE 220. MICROSEMI: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 221. MYTHIC: COMPANY SNAPSHOT

TABLE 222. MYTHIC: PRODUCT PORTFOLIO

TABLE 223. MYTHIC: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 224. NEC: COMPANY SNAPSHOT

TABLE 225. NEC: OPERATING SEGMENTS

TABLE 226. NEC: PRODUCT PORTFOLIO

TABLE 227. NEC: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 228. CROSSCERT: COMPANY SNAPSHOT

TABLE 229. CROSSCERT: OPERATING SEGMENTS

TABLE 230. CROSSCERT: PRODUCT PORTFOLIO

TABLE 231. CROSSCERT: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 232. NVIDIA: COMPANY SNAPSHOT

TABLE 233. NVIDIA: OPERATING SEGMENTS

TABLE 234. NVIDIA: PRODUCT PORTFOLIO

TABLE 235. NVIDIA: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 236. NXP: COMPANY SNAPSHOT

TABLE 237. NXP: OPERATING SEGMENTS

TABLE 238. NXP: PRODUCT PORTFOLIO

TABLE 239. NXP: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 240. QUALCOMM: COMPANY SNAPSHOT

TABLE 241. QUALCOMM: OPERATING SEGMENTS

TABLE 242. QUALCOMM: PRODUCT PORTFOLIO

TABLE 243. QUALCOMM: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 244. SAMSUNG: COMPANY SNAPSHOT

TABLE 245. SAMSUNG: OPERATING SEGMENTS

TABLE 246. SAMSUNG: PRODUCT PORTFOLIO

TABLE 247. SAMSUNG: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 248. THINK FORCE: COMPANY SNAPSHOT

TABLE 249. THINK FORCE: PRODUCT PORTFOLIO

TABLE 250. THINK FORCE: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 251. SK HYNIX: COMPANY SNAPSHOT

TABLE 252. SK HYNIX: OPERATING SEGMENTS

TABLE 253. SK HYNIX: PRODUCT PORTFOLIO

TABLE 254. SK HYNIX: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 255. SOFTBANK GROUP: COMPANY SNAPSHOT

TABLE 256. SOFTBANK GROUP: OPERATING SEGMENTS

TABLE 257. SOFTBANK GROUP: PRODUCT PORTFOLIO

TABLE 258. SOFTBANK GROUP: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 259. TSMC: COMPANY SNAPSHOT

TABLE 260. TSMC: OPERATING SEGMENTS

TABLE 261. TSMC: PRODUCT PORTFOLIO

TABLE 262. TSMC: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 263. TENSTORRENT: COMPANY SNAPSHOT

TABLE 264. TENSTORRENT: PRODUCT PORTFOLIO

TABLE 265. TENSTORRENT: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 266. TI: COMPANY SNAPSHOT

TABLE 267. TI: OPERATING SEGMENTS

TABLE 268. TI: PRODUCT PORTFOLIO

TABLE 269. TI: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 270. TOSHIBA: COMPANY SNAPSHOT

TABLE 271. TOSHIBA: OPERATING SEGMENTS

TABLE 272. TOSHIBA: PRODUCT PORTFOLIO

TABLE 273. TOSHIBA: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 274. UC: COMPANY SNAPSHOT

TABLE 275. UC: PRODUCT SEGMENTS

TABLE 276. UC: PRODUCT PORTFOLIO

TABLE 277. UC: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 278. WAVE COMPUTING: COMPANY SNAPSHOT

TABLE 279. WAVE COMPUTING: PRODUCT PORTFOLIO

TABLE 280. WAVE COMPUTING: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

TABLE 281. XILINX: COMPANY SNAPSHOT

TABLE 282. XILINX: PRODUCT PORTFOLIO

TABLE 283. XILINX: TECHNOLOGICAL INSIGHTS AND KEY ARCHITECTURES

LIST OF FIGURES

FIGURE 01. KEY MARKET SEGMENTS

FIGURE 02. EXECUTIVE SUMMARY

FIGURE 03. EXECUTIVE SUMMARY

FIGURE 04. INDUSTRY ROADMAP

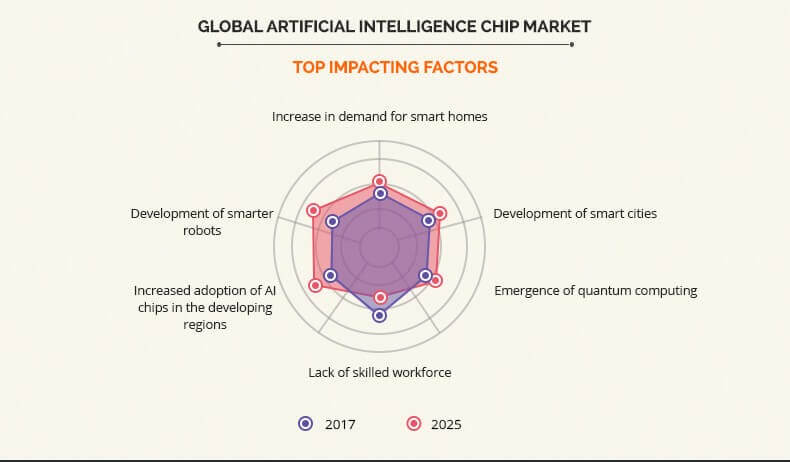

FIGURE 05. TOP IMPACTING FACTORS

FIGURE 06. TOP INVESTMENT POCKETS

FIGURE 07. TOP WINNING STRATEGIES, BY YEAR, 20142018*

FIGURE 08. TOP WINNING STRATEGIES, BY YEAR, 20142018*

FIGURE 09. TOP WINNING STRATEGIES, BY COMPANY, 20142018*

FIGURE 10. MODERATE-TO-HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 11. MODERATE-TO-HIGH THREAT OF NEW ENTRANTS

FIGURE 12. MODERATE THREAT OF SUBSTITUTES

FIGURE 13. HIGH-TO-MODERATE INTENSITY OF RIVALRY

FIGURE 14. HIGH-TO-MODERATE BARGAINING POWER OF BUYERS

FIGURE 15. MARKET SHARE ANALYSIS, 2017 (%)

FIGURE 16. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY CHIP TYPE, 20172025 (%)

FIGURE 17. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR GPU, BY COUNTRY, 2017 & 2025 (%)

FIGURE 18. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR ASIC, BY COUNTRY, 2017 & 2025 (%)

FIGURE 19. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR FPGA, BY COUNTRY, 2017 & 2025 (%)

FIGURE 20. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR CPU, BY COUNTRY, 2017 & 2025 (%)

FIGURE 21. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR OTHERS, BY COUNTRY, 2017 & 2025 (%)

FIGURE 22. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY APPLICATION, 20172025 (%)

FIGURE 23. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY DEEP LEARNING, 20172025 (%)

FIGURE 24. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY PREDICTIVE ANALYSIS, 20172025 (%)

FIGURE 25. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY OTHERS, 20172025 (%)

FIGURE 26. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR MACHINE LEARNING, BY COUNTRY, 2017 & 2025 (%)

FIGURE 27. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY TRANSLATION, 20172025 (%)

FIGURE 28. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY CLASSIFICATION & CLUSTERING, 20172025 (%)

FIGURE 29. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY INFORMATION EXTRACTION, 20172025 (%)

FIGURE 30. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR NLP, BY COUNTRY, 2017 & 2025 (%)

FIGURE 31. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR ROBOTIC PROCESS AUTOMATION, BY COUNTRY, 2017 & 2025 (%)

FIGURE 32. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY SPEECH TO TEXT, 20172025 (%)

FIGURE 33. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY TEXT TO SPEECH, 20172025 (%)

FIGURE 34. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR SPEECH RECOGNITION, BY COUNTRY, 2017 & 2025 (%)

FIGURE 35. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR OTHERS, BY COUNTRY, 2017 & 2025 (%)

FIGURE 36. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY TECHNOLOGY, 20172025 (%)

FIGURE 37. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR SYSTEM-ON-CHIP (SOC), BY COUNTRY, 2017 & 2025 (%)

FIGURE 38. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR SYSTEM-IN-PACKAGE (SIP), BY COUNTRY, 2017 & 2025 (%)

FIGURE 39. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR MULTI-CHIP MODULE, BY COUNTRY, 2017 & 2025 (%)

FIGURE 40. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR OTHERS, BY COUNTRY, 2017 & 2025 (%)

FIGURE 41. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY TECHNOLOGY, 20172025 (%)

FIGURE 42. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR EDGE, BY COUNTRY, 2017 & 2025 (%)

FIGURE 43. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR CLOUD, BY COUNTRY, 2017 & 2025 (%)

FIGURE 44. GLOBAL ARTIFICIAL INTELLIGENCE CHIP MARKET SHARE, BY INDUSTRY VERTICAL, 20172025 (%)

FIGURE 45. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR MEDIA & ADVERTISING, BY COUNTRY, 2017 & 2025 (%)

FIGURE 46. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR BFSI, BY COUNTRY, 2017 & 2025 (%)

FIGURE 47. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR IT & TELECOM, BY COUNTRY, 2017 & 2025 (%)

FIGURE 48. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR RETAIL, BY COUNTRY, 2017 & 2025 (%)

FIGURE 49. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR HEALTHCARE, BY COUNTRY, 2017 & 2025 (%)

FIGURE 50. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR AUTOMOTIVE, BY COUNTRY, 2017 & 2025 (%)

FIGURE 51. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET FOR OTHERS, BY COUNTRY, 2017 & 2025 (%)

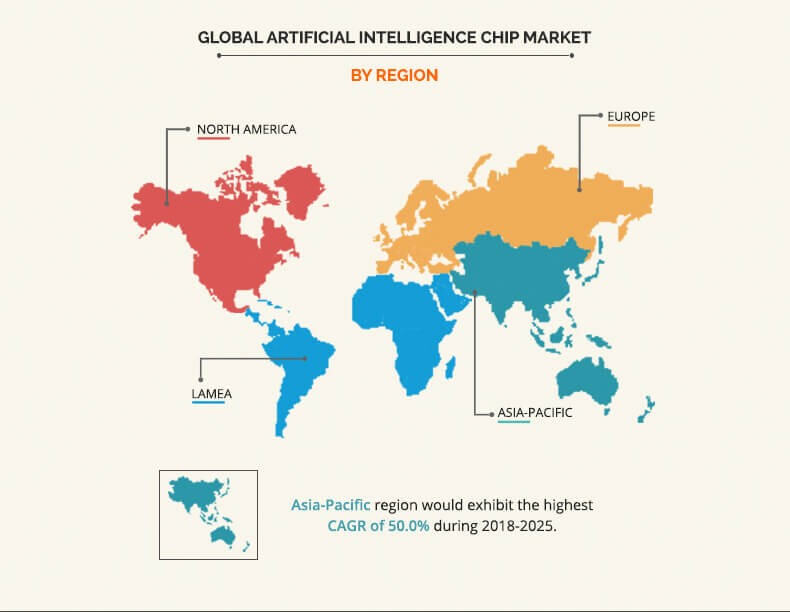

FIGURE 52. ARTIFICIAL INTELLIGENCE CHIP MARKET, BY REGION, 2017-2025 (%)

FIGURE 53. COMPARATIVE SHARE ANALYSIS OF ARTIFICIAL INTELLIGENCE CHIP MARKET, BY COUNTRY, 20172025 (%)

FIGURE 54. U. S. ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 55. CANADA ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 56. MEXICO ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 57. COMPARATIVE SHARE ANALYSIS OF EUROPE ARTIFICIAL INTELLIGENCE CHIP MARKET, BY COUNTRY, 20172025 (%)

FIGURE 58. U.K. ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 59. GERMANY ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 60. FRANCE ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 61. RUSSIA ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 62. REST OF EUROPE ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 63. COMPARATIVE SHARE ANALYSIS OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, BY COUNTRY, 20172025 (%)

FIGURE 64. CHINA ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 65. JAPAN ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 66. INDIA ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 67. AUSTRALIA ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 68. REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 69. COMPARATIVE SHARE ANALYSIS OF LAMEA ARTIFICIAL INTELLIGENCE CHIP MARKET, BY COUNTRY, 20172025 (%)

FIGURE 70. LATIN AMERICA ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 71. MIDDLE EAST ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 72. AFRICA ARTIFICIAL INTELLIGENCE CHIP MARKET, 20172025 ($MILLION)

FIGURE 73. AMD: NET SALES, 20152017 ($MILLION)

FIGURE 74. AMD: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 75. AMD: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 76. ALPHABET: NET SALES, 20152017 ($MILLION)

FIGURE 77. ALPHABET: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 78. ALPHABET: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 79. AMAZON.COM: NET SALES, 20152017 ($MILLION)

FIGURE 80. AMAZON.COM: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 81. ANALOG DEVICES: NET SALES, 20152017 ($MILLION)

FIGURE 82. ANALOG DEVICES: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 83. ANALOG DEVICES: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 84. APPLIED MATERIALS: NET SALES, 20152017 ($MILLION)

FIGURE 85. APPLIED MATERIALS: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 86. APPLIED MATERIALS: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 87. BAIDU: NET SALES, 20152017 ($MILLION)

FIGURE 88. BAIDU: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 89. BROADCOM: NET SALES, 20152017 ($MILLION)

FIGURE 90. BROADCOM: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 91. BROADCOM: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 92. HUAWEI: NET SALES, 20142016 ($MILLION)

FIGURE 93. HUAWEI: REVENUE SHARE BY SEGMENT, 2016 (%)

FIGURE 94. HUAWEI: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 95. INTEL: NET SALES, 20152017 ($MILLION)

FIGURE 96. INTEL: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 97. INTEL: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 98. IBM: NET SALES, 20152017 ($MILLION)

FIGURE 99. IBM: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 100. IBM: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 101. MEDIATEK: NET SALES, 20142016 ($MILLION)

FIGURE 102. MEDIATEK: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 103. MICRON: NET SALES, 20152017 ($MILLION)

FIGURE 104. MICRON: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 105. MICRON: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 106. MICROSEMI: NET SALES, 20152017 ($MILLION)

FIGURE 107. MICROSEMI: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 108. NEC: NET SALES, 20152017 ($MILLION)

FIGURE 109. NEC: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 110. NVIDIA: NET SALES, 20152017 ($MILLION)

FIGURE 111. NVIDIA: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 112. NVIDIA: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 113. NXP: NET SALES, 20142016 ($MILLION)

FIGURE 114. NXP: REVENUE SHARE BY SEGMENT, 2016 (%)

FIGURE 115. NXP: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 116. QUALCOMM: NET SALES, 20152017 ($MILLION)

FIGURE 117. QUALCOMM: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 118. SAMSUNG: NET SALES, 20152017 ($MILLION)

FIGURE 119. SAMSUNG: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 120. SAMSUNG: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 121. SK HYNIX: NET SALES, 20142016 ($MILLION)

FIGURE 122. SOFTBANK GROUP: NET SALES, 20152017 ($MILLION)

FIGURE 123. SOFTBANK GROUP: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 124. SOFTBANK GROUP: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 125. TSMC: NET SALES, 20142016 ($MILLION)

FIGURE 126. TSMC: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 127. TI: NET SALES, 20152017 ($MILLION)

FIGURE 128. TI: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 129. TI: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 130. TOSHIBA: NET SALES, 20152017 ($MILLION)

FIGURE 131. TOSHIBA: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 132. TOSHIBA: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 133. UC: NET SALES, 20152017 ($MILLION)

FIGURE 134. UC: REVENUE SHARE BY PRODUCT SEGMENT, 2017 (%)

FIGURE 135. XILINX: NET SALES, 20152017 ($MILLION)

FIGURE 136. XILINX: REVENUE SHARE BY PRODUCT, 2017 (%)

FIGURE 137. XILINX: REVENUE SHARE BY GEOGRAPHY, 2017 (%)